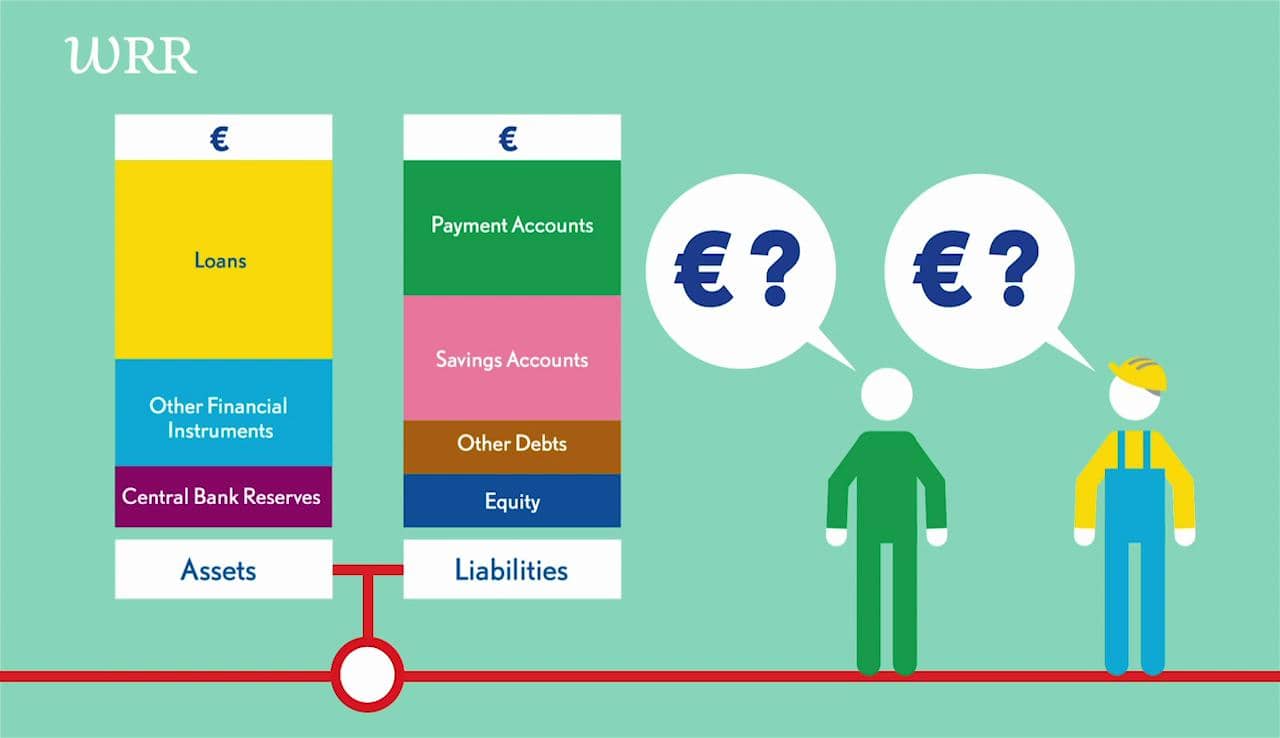

The creation of new money is an important, if largely invisible process in our economy and society. Contrary to what most people think, new money is created by commercial banks. Banks create money whenever a loan is granted. Although this process of money creation has existed for a long time, the context in which it takes place has slowly but notably changed over the past decades. There has been a significant shift from cash to deposit money. Public payment and savings facilities have all but disappeared. The Dutch banking sector became much more concentrated and homogenous. This means that the traditional constraints on money and credit creation are weaker than they used to be.

Two core problems

The WRR identifies two core problems in the financial and monetary system. First, the high level of private debt contributes to financial instability, longer recovery after a crisis and increased economic volatility. Second, there is an imbalance between public and private interests in the banking sector, with a limited number of banks having become essential for key public services, such as the payment infrastructure, lending and financial stability.

Ambitious policy needed

The WRR recommends a more ambitious policy to remedy these problems in our current system. In particular, it recommends promoting greater diversity in the financial sector, curbing excessive growth of debt, being better prepared for the next crisis and safeguarding the public responsibilities of the banking sector.

The report

The report ‘Money and Debt’ (Geld en Schuld) was presented on January 17th, 2019 to the Dutch government. This report is the result of a formal request by the Dutch Minister of Finance for an advise on the functioning of the monetary system, as suggested in a motion adopted by the Dutch Parliament during a debate on money creation. This debate was the result of the citizen initiative ‘Our Money’ (‘Ons Geld’). The English version of the full report will soon be available. An English summary of our report is already available